michigan gas tax revenue

0272 gallon. However certain mining operations are subject to specific taxes levied on the minerals mineral-bearing land from which the minerals are mined andor property related to the mining.

States Consider Gas Tax Pauses As Prices Spike The Hill

Avalara can simplify fuel energy and motor tax rate calculation in multiple states.

. Producers or purchasers are required to report the oil and gas production and the. Motor fuel taxes are levied on. Motor fuel taxes are levied on.

City Individual Income Tax Notice IIT Return Treatment of Unemployment Compensation City Business and Fiduciary Taxes. Revenue from the motor fuel taxes is dedicated by the 1963 Michigan Constitution for transportation. Motor Fuel - Letter of Inquiry Concerning Michigan Taxes.

Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. That is a responsible first step in ensuring that our. Federal Excise Tax In addition to Michigans 19-cent.

Tax revenue in FY 2010-11. Gretchen Whitmer proposed a 45-cent gas tax increase that would be phased in over two years in three increments. Weve included gasoline diesel aviation fuel and jet fuel tax rates for 2022.

History of Michigan Gas and Diesel Fuel Tax Rates Sources. By James M. Bureau of Labor Statistics US.

003 gallon. If you have any questions in regards to this. Hohman May 26 2020.

Notice of New Sales Tax Requirements for Out-of-State Sellers. Motor Fuel Taxes In Michigan three taxes are included in the retail price of gasoline. Streamlined Sales and Use Tax Project.

The goal Whitmer said. We can shift out the sales tax at the pump and replace it with a revenue-neutral gas tax Chatfield told reporters Thursday. City Individual Income Tax.

In Michigan the revenue from regular gasoline sales tax was projected to be 621 million in the 2022 fiscal year. Avalara can simplify fuel energy and motor tax rate calculation in multiple states. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy.

MICHIGANS MOTOR FUEL AND REGISTRATION TAXES FY 2016 - 2017 Office of Revenue and Tax Analysis Tax Analysis Division Michigan Department of Treasury May 2019 This report. Although directed to the Michigan Transportation Fund revenue from the Michigan gasoline tax broke 1000 million for the fifth time in the last 12 months. This RAB supersedes RAB.

This RAB also identifies the calculation method used to determine the prepaid sales tax rate for gasoline and diesel fuel. Michigans Democratic Gov. 003 gallon.

People are driving less during the COVID-19 pandemic. The state uses this. The Michigan Severance Tax Act MCL 205301 levies a tax on oil and gas severed from the soil in Michigan.

The budget proposes rolling back the retirement tax to put an average of 1000. But that was based on an expected average price per gallon at. For transactions occurring on and after October 1 2015 an out-of-state seller may be.

Although directed to the Michigan Transportation Fund revenue from the Michigan gasoline tax broke 1000 million for the fifth time in the last 12 months. The owner of the motor fuel is required to fill out form number 4010 and remit any additional motor fuel tax that may be owed to the Department. In February Governor Whitmer proposed her budget proposal for the upcoming fiscal year.

Currently state gas taxes range from 1432 cents per gallon in Alaska to 6205 cents per gallon in California not including the 184 cents per gallon federal gas tax they. See current gas tax by state. Fiscal Year Ending 1987 1989 1991 1993.

As a result the state governments fuel tax revenue is falling. 0272 gallon. The Federal gasoline tax 184 cents per gallon the Michigan sales tax levied at a rate of 60 on a base.

Roads Get Spotlight But 447 Michigan Bridges In Serious Condition Or Worse Bridge Michigan

:max_bytes(150000):strip_icc()/pumpgas-5ae60d0beb97de0039a2f57a.jpg)

Gas Taxes And What You Need To Know

Roads Get Spotlight But 447 Michigan Bridges In Serious Condition Or Worse Bridge Michigan

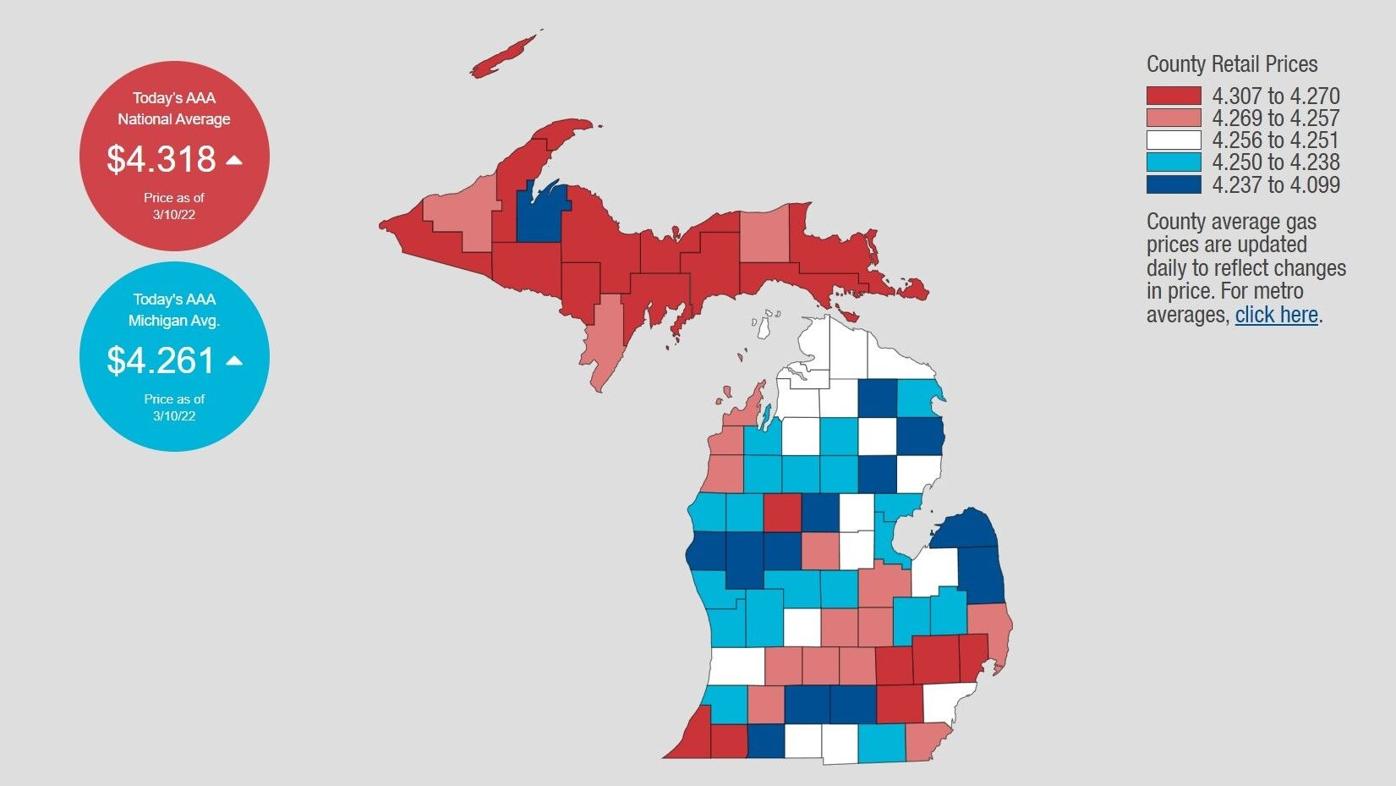

Michigan Breaks Records For Highest Gasoline And Diesel Fuel Prices State Abc12 Com

Resident Information Ottawa County Road Commission Michigan

Michigan Gasoline And Fuel Taxes For 2022

The Politics Of A Gas Tax Holiday Explained Minnpost

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

Iowa Gas Tax Holiday Appears Unlikely As Prices At Pumps Rise The Gazette

Roads Get Spotlight But 447 Michigan Bridges In Serious Condition Or Worse Bridge Michigan

![]()

Michigan Gasoline And Fuel Taxes For 2022

The Politics Of A Gas Tax Holiday Explained Minnpost

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

Michigan Gasoline And Fuel Taxes For 2022

Sen Johnson Supports Gas Tax Pause For Michigan Motorists Michigan Senate Republicans